October 2019 Markets in a Minute

Markets start to respond to positive US-China negotiations

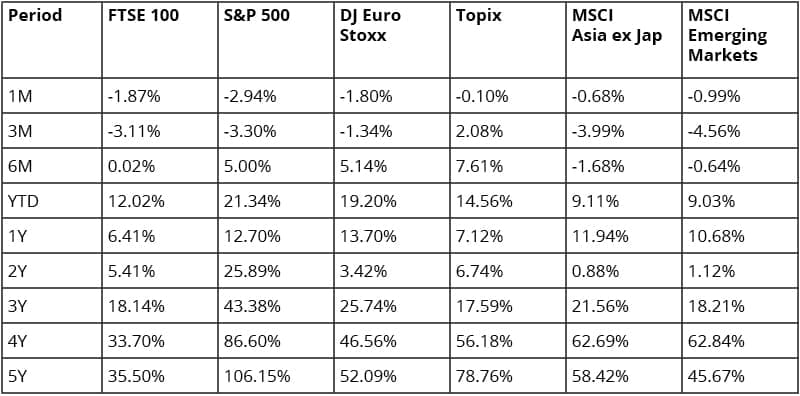

- UK investors will likely have endured losses from their investment portfolios in October as the major equity and bond indices lost money over the period in sterling terms.

- However, these losses mask what is an improving story for the global economy and stock markets. The pound advanced roughly 4% in October, more than eroding the gains enjoyed from international equity positions.

- In relation to the FTSE, the global companies that dominate the index will have suffered earnings downgrades as international revenues translate to fewer pounds.

- In dollar terms stock markets enjoyed healthy returns around the world as the major (perceived) geopolitical threats to the global economy receded; particularly in relation to the US China trade standoff, and Brexit.

- Reports suggest the US-China negotiations will be completed using a ‘phased’ strategy. ‘Phase one’ will look to tackle trade specifically, with the US seeking a commitment from China to purchase an agreed level of US product (with agriculture and aerospace dominating) and to not cynically devalue their currency,

- US administration has agreed to defer the impending additional tariffs on Chinese imports and will explore rolling back on existing levies.

- ‘Phase Two’ will tackle far more challenging issues such as Intellectual Property rights.

- Concrete progress on trade relations between the world’s two major superpowers should deliver a significant boost to confidence in the manufacturing sector, the part of global economy bearing the most strain

UK risk appetite returns

- Turning to domestic matters and at one stage it appeared as though the Prime Minister might just get his surprise Brexit deal through Parliament, and also in time for his much-vaunted October 31st deadline.

- It was not to be, however, and the government instead secured Parliamentary approval for a Dec 12th General Election.

- History tells us there is much to play for in the election, despite the current Tory lead in the polling. The major takeaway at this stage, however, is that a ‘No deal’ Brexit looks a significantly reduced possibility; at least in the coming 12 months. This realisation appears to have not only lifted sterling but risk appetite more generally.

- Discussions with our market analysts guided investments towards a reduction in Asian equities in October, recommending a neutral weighting. Whilst recognising the improvements made on US China trade issues, the lingering threat of Hong Kong civil unrest weighed on conviction levels.

- The sentiment guided towards cash raised being redeployed to Europe which would be a clear beneficiary of an improvement in the manufacturing cycle and, for now, has less to worry about politically.