Trump’s Second Term: What it Means for the Energy Transition and Sustainable Investments

It is no secret that Trump is not an energy transition enthusiast. With the Republicans gaining control of both the House and the Senate, investors are fearful Trump will not only increase fossil fuel production but also roll back clean energy incentives already in place.

However, we note that this rhetoric is not new. Therefore, it is important to reflect on what happened in his first term to assess what this may mean today.

Trump 1.0

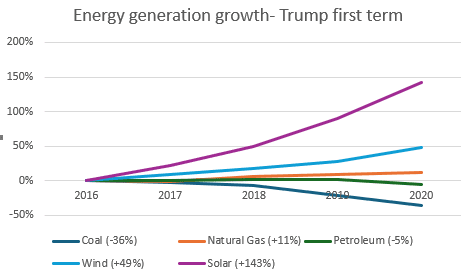

During Trump’s first term, the rhetoric strongly supported coal and aimed to slow down renewable investments. In reality, solar and wind generation increased by 143% and 49% respectively with coal generation reducing by -36%.

So why the difference? We highlight three key reasons:

- Federal vs state government: There is a significant division of power between the federal and state governments. Throughout Trump’s first term, state governmentscontinued to incentivise renewable expansion despite federal policies.

- Corporates: Net zero commitments were increasingly adopted by corporates, incentivising private and public investment in renewable energy.

- Economic rationale: The cost of wind and solar continued to fall, making it economically viable for businesses and governments to invest in these projects rather than more expensive new fossil fuel projects.

What does this mean for today?

Corporates

We have seen the likes of Microsoft hold the line on their ambitious net-zero targets even as their energy consumption continues to climb exponentially due to AI advancements. While this places further political pressure on states to provide clean energy and attract these businesses, there has been significant private funding from the businesses themselves for energy projects.

Furthermore, tightening regulation around the world will also sustain corporate commitments. If US firms want to maintain their presence in global markets such as Europe, they will have to continue to think about their sustainable strategy (including net zero) regardless of domestic policy.

Economic rationale

It is important to recognise that energy security will be a key focus of Trump’s second term alongside efforts to tackle inflation. As it stands, renewables are still the cheapest form of new electricity generation. Given the rise in energy demand, increasing capacity in renewables will be key for not only addressing energy concerns but also moderating energy prices in the US.

Outside of the US

Having outlined all of the above, clearly a Trump-led administration is not ideal for the clean energy sector. It is likely fossil fuel production will increase and US leadership in global organisations related to climate will recede. Will this deter global efforts to the energy transition?

Most major global leaders are still supportive of scaling up renewable capacity and reducing fossil fuel use. Why? Many countries lack significant fossil fuel reserves and therefore have limited energy security and independence. With geopolitical uncertainty on the rise and attractive costs of wind and solar, nations see clear economic and political benefits in the energy transition.

Looking ahead

While the Trump administration will be more favourable to fossil fuels and may reduce federal support for renewables, there will be opposing forces that should keep the energy transition on track, much as they did during his first term.

For sustainable portfolios, it is also important to remember that whilst the energy transition and America’s role within it is a structural megatrend, our partner investment frameworks are much broader. Our investment partners focus on the overall economic transition to a more sustainable model. This holistic approach ensures portfolios are well diversified across regions, sectors, and themes.

We know with Trump in the White House, structural change will not always follow a linear path. As such, it is important to actively manage investment portfolios to navigate short-term volatility and capitalise on long-term trends.

We actively monitor developments and meet regularly with our expert partners to ensure your investments remain aligned with long-term sustainable growth. If you have any questions about how these changes may affect your portfolio, please reach out to us for tailored guidance on navigating the evolving landscape of sustainable investment.