Oil price plunge adds to stock market pressures

Posted by siteadmin on Tuesday 10th of March 2020.

Markets fall in response to oil price war

While most people spent the weekend dealing with the prospect of the COVID-19 epidemic taking hold of UK life, the financial community woke up yesterday to another, different – even if slightly more familiar – type of upset: an oil price shock that unfolded over the weekend.

Following on from what has been a tumultuous time for investments, the morning of the 9th March saw stock markets worldwide reacting negatively to the news of a significant fall in the price of oil.

Saudi Arabia effectively launched an oil price war against competitors such as Russia and the US. This caused the price of a barrel of crude oil to fall over 30% at one point, the largest one-day fall seen since the Gulf War in 1991.

The implications and what happens next

The real impact of both the continuing Coronavirus outbreak and the oil price crash will not be known for many months. We expect leading central banks around the world to react and implement strategies to provide short-term support to markets wherever possible.

Our take on this week's stock market rout is that faced with this shock surprise action by oil exporters, market participants have become overwhelmed by a doubling up of concerns from the virus disruptions and memories of what happened the last time when oil prices traded at these levels.

With oil-producing companies still ranking among some of the largest, and very importantly some of the most highly indebted companies in the world, the knock-on effect of them coming under financial pressure could be substantial.

The FTSE 100 dipped over 8% in early trading on Monday, as investors came to terms with the facts and attempted to shelter themselves from the volatility. Prices of government bonds around the world have risen sharply, as investors look towards traditional safe havens.

The next few weeks, at least, are likely to be a bit of a roller-coaster. But volatility is a two way street. The biggest daily market gains often follow the biggest falls, although, there are no guarantees. At the time of writing this we have seen a 3% bounce on most European markets.

We’re not forecasting the end of this torrid spell, we will continue to make sure you are properly diversified and question fund managers where appropriate. Your portfolios remain well diversified, both geographically and by asset class. The equity portion of your investment portfolio will, of course, have been negatively affected by falling markets. However, your portfolios also include fixed income assets and alternative investments such as infrastructure, which helps to provide some stability.

Invested for the long term

We would like to reiterate that your investment portfolio is designed to deliver positive, risk-adjusted returns that outpace inflation over any rolling five-year period. The current situation is of course uncomfortable for any client, but we are keen to remind clients to remain focused on the longer-term returns of their investment portfolios.

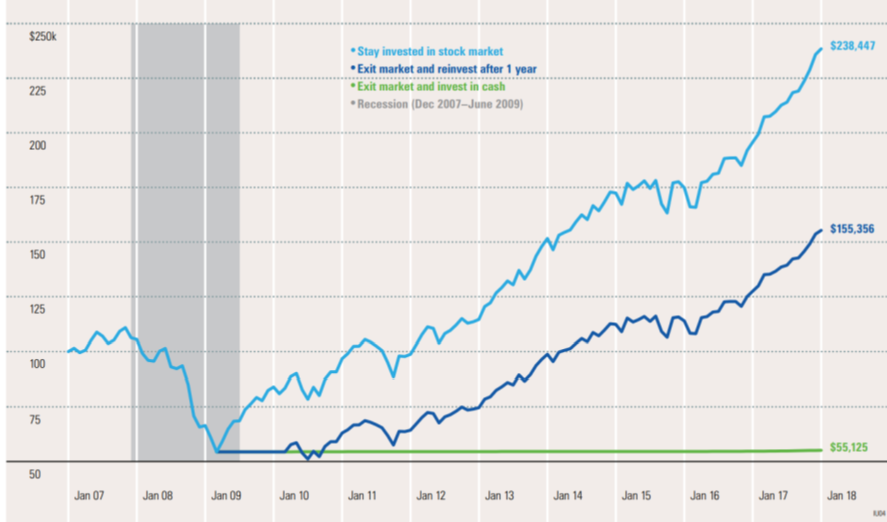

To try and illustrate this long term view, the graph below illustrating the importance of staying invested. In the aftermath of the financial crisis in late 2008, an investor who held their position throughout ended up with a portfolio value approximately 50% greater than if they had decided to sell out of the market at its lowest point and bought back in one year later.

Staying invested for long term

Source: Morningstar. This is the for illustrative purposes only and represents the value of $100k invested in the S&P 500 Index over the timescale shown.

Keeping you informed

We continue to speak to the fund managers and investment specialists to gain their insight and understanding of the situation. We are committed to keeping you informed so will continue to provide regular updates and of course welcome your calls to discuss further.

We want all of our clients to have a positive long term experience of investing and we will continue to keep you updated with useful information. Please do not hesitate to contact us to discuss further.

You are now departing from the regulatory site of Financial Advice Centre Ltd. Financial Advice Centre Ltd is not responsible for the accuracy of the information contained within the site.