FINANCIAL ADVICE CENTRE NEWS

Your Summer Newsletter 2021

Your Adviser Discusses: Inflation

Inflation, the general rise in the price level of an economy over a period of time, reflects a reduction in the purchasing power per unit of money – a loss of real value. High rates of inflation can be harmful and are caused by excessive growth of the money supply. There is a feeling in the investment community that we are seeing this today, with the likes of President Biden pumping trillions of US Dollars into the economy.

Inflation affects economies in various ways and if rapid enough, shortages of goods can occur with consumers excessively buying products and services in fear of future price hikes, which compounds the issue further. Today, most economists favour a low and steady rate of inflation. However, in times where fiscal policy dominates, inflation is the risk all investors should now be guarding against.

For years, market participants have been told that inflation has been too low. Now that it has smashed through the Federal Reserve’s 2% target, there is a prospect of much higher prices for goods and services.

When we talk to clients about investments, for many the first thing they think about is the risk involved. What we aim to explain is that in order to make a reasonable return, you need to take a reasonable risk.

However, what many do not think about is the risk of doing nothing. Inflation erodes the purchasing power of the pound in your pocket and even money in a savings account is unlikely to bear enough interest to keep pace with the change in prices. This problem is exacerbated when increasing inflation is accompanied by low interest rates over time.

Just to illustrate this a bit more effectively let’s say you have £5,000 in the bank getting interest of 0.5% per annum and inflation is 1.5%. After 10 years you will show £5,255 in your bank account but it will only pay for £4,500 worth of goods or services in today’s money. If we increase the inflation rate to 2.0% (the target rate for the Bank of England) then the purchasing power of your savings over the 10 years has decreased to £4,300. All without taking a single investment risk.

In order to retain the purchasing power of your hard-earned savings, it is exactly at times like this that investment makes sense. There is simply no other effective way to retain value.

Let’s look at investment risk on a scale of 1 to 10, where 1 is putting the money into a savings account and 10 is taking a trip to the casino.

An investment at a level 3/10 should be enough to keep pace with inflation over time after charges, and perhaps exceed it, over the economic cycle.

This comparatively low risk portfolio which is well diversified, with the risk spread over many asset types helps to smooth out the volatility of the markets.

We would always suggest keeping an amount of cash in the bank, for emergencies, but beyond this it is worth considering investment as a hedge against the inevitable march of increasing prices.

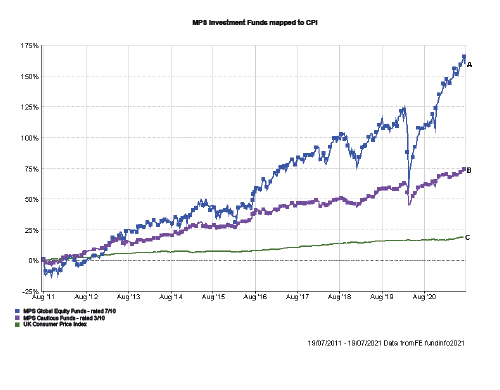

Please look at the chart we have provided below which shows the difference over time of the last 10 years.

We have mapped the CPI (to show inflation); an investment portfolio (10 being the highest) with a risk profile of 3 out of 10. and a risk portfolio rated 7/10 to show the returns over time.

You can clearly see the difference in the value of these funds over time.